The Theranos Verdict: In Healthcare, Money Should Follow Science

MDisrupt CEO and founder Ruby Gadelrab on the best way for investors to avoid Theranos-style mistakes

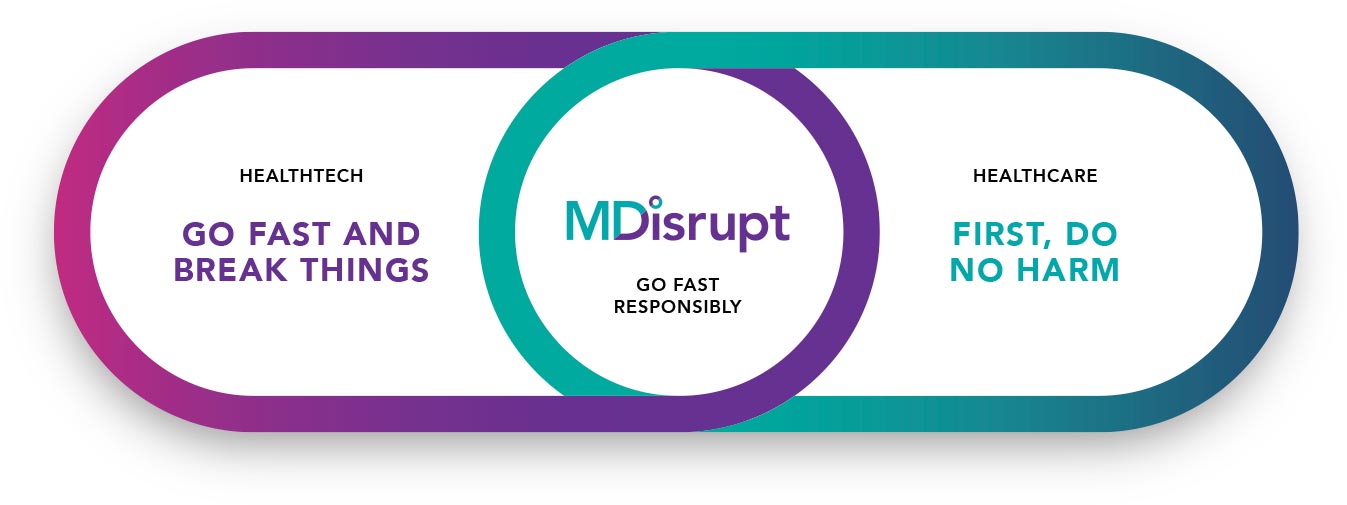

“Move fast—responsibly.”

Silicon Valley has become known for its’ “go fast and break things” approach. But the core principle of healthcare is “do no harm.” However, one cannot safely, ethically or legally “fake it until you make it” when patients’ health and lives are at stake.

That’s one clear takeaway from the verdict that found Elizabeth Holmes, founder and former CEO of the health technology company Theranos, guilty on four counts of defrauding her investors about the company’s blood-testing technology.

From my perspective, it’s extremely unfortunate that Holmes was acquitted of four other counts of fraud involving patients who said they were deceived by Theranos’s claims. While investors were indeed deceived, they had the opportunity to look more closely at Theranos before investing. Patients who believed the company’s claims did not have that option. In this verdict, investors were vindicated, patients were not.

But in the rush to draw meaning from the verdict, let’s not assume that all digital health companies—or even most of them—are like Theranos. There are plenty of healthtech companies out there who are eager to go fast, responsibly—and plenty of investors willing to do the homework that Theranos’s investors skipped.

While healthcare is complex, highly regulated, and probably the hardest area in which to invest, there is a clear formula that investors can follow to avoid making costly—in every sense of the word—Theranos-style mistakes.

Invest in medical diligence

Investors routinely do technical and financial diligence using experts. When investing in healthcare technology companies, investors must also do medical diligence using healthcare experts. It’s a critical element of establishing whether a product is commercially and clinically viable.

The 5 elements of medical diligence

1) Does the technology actually work? This is often known as analytical validation or technology validation. Investors need to determine if there is evidence to back up the founders’ claims. And the marketing must be truthful. It is both unethical and illegal to overstate claims.

2) Show me the data! (Ask for the clinical validation data.) Does the technology actually pick up a disease or biomarker when it’s present—and not pick it up when it’s not there? Not all data are created equal. Good data are generated externally with scientists and research labs, great data are published in peer-reviewed journals, and excellent data are published and replicated. In the case of Theranos, every time they were asked for the data they claimed that they didn’t want to share their “trade secrets.” In healthcare you have to publish your studies and also submit them to regulatory bodies.

3) Evaluate the clinical utility. Ok, the technology works, and successfully detects what it is supposed to. But is the product clinically useful? Does it actually solve a real problem in healthcare or is it just technology for sake of technology looking for an application in healthcare? Will it actually change or impact the medical management of a patient? Is there buy-in from both health systems and healthcare providers?

4) Review the health economic data. How much does the technology cost to implement, and how much does it save the healthcare system compared to the standard of care? Will there be, or is there, Medicare, Medicaid, or private insurance reimbursement for the treatment or product?

5) Confirm legal and regulatory compliance. Has the founder evaluated all the laws and regulations that apply? Can the founders prove that the company and the technology are compliant with those laws? What is the reporting structure of the general counsel, the chief compliance officer, and/or the privacy officer? Are there any conflicts of interest with the same? Healthcare is one of the most regulated industries in the US, making healthcare compliance a crucial and growing field within the industry.

Look closely at company structure & culture

Make sure the RIGHT healthcare experts have a seat at the table and a strong voice in the process (and are not just there for show and credentials). There are a few important signals that can help investors determine whether this is happening.

For instance, does the company have physicians, scientists, or clinical experts within the team, or as investors? On the board of directors? What about as part of the C-suite or in senior positions? The most successful healthcare startups have a balance of clinical, commercial and tech skill sets. And ideally, a digital health company would have a chief medical officer and chief compliance officer on the executive team even in fractional roles. At MDisrupt, one of our specialties is matching vetted healthcare industry experts with digital health startups so they can access all the essential skills they need, on demand.

Company culture is also important. Talk to the employees—do they see a culture of silence and secrecy, or one of transparency and collaboration? One red flag: When there is high turnover in scientific, clinical, or compliance positions, a company is in trouble. (I know this because many such individuals join our expert network at MDisrupt. In fact, often the culture is so bad that they leave the company before they have other jobs.)

Don’t assume all healthtech startups are like Theranos

Every day I meet incredible truth-seeking founders and who are building life-changing health technology products. Unfortunately and unfairly, many are being greeted with skepticism in the shadow of Theranos—particularly women founders, lab testing companies, and companies focusing on point of care and blood collection devices. Yet all it takes is some medical diligence to be able to separate the truth-seekers from the rest.

Involve experts from the start

Engaging the right experts early and often in the development of a health product can be the key to adoption and scale within a healthcare setting. By building collaborative partnerships between digital health and health industry experts, we can get the best of both worlds.

If you want to dive into more interesting topics related to healthcare, check out our blog at MDisrupt.

At MDisrupt, we believe the health products with the most potential to do good in the world should make it to market quickly. We help make this happen by connecting ambitious digital health innovators to the healthcare experts who have the skills they need most.

Our experts span the healthcare continuum and can assist with all stages of health product development: This includes regulatory, clinical studies and evidence generation, payor strategies, commercialization, and channel strategies. If you are building a health product, talk to us.