Access simply the best on-demand health technology experts, anywhere.

Deep healthcare knowledge. Unlocked.

MDisrupt is the premier marketplace for on-demand clinical, commercial, and regulatory experts. Leading health technology companies hire MDisrupt experts for building, commercializing, and scaling their products.

Trusted By

Build the team you need, when you need it.

Hire healthcare industry veterans with expertise across the entire product lifecycle today. We can match experts to your project through our tech-enabled platform with more efficiency, less risk, and better results.

Medical / Clinical

Experts

Chief Medical Officers and clinician advisors covering 35 medical disciplines

Not seeing what you’re looking for? Let’s talk

Find your expert now.

Create your project

Join the MDisrupt platform and tell us about your project.

Meet the perfect experts

Our MDisrupt platform helps match your needs with our health experts’ knowledge and skills. Interview and select your experts.

Simplified logistics

Found the perfect expert? MDisrupt handles all the details including contracting, payment processing, liability insurance, and more.

Get to work

Collaborate with best in class experts to meet your milestones faster.

Achieve your goals. Faster.

As the health industry’s premier expert marketplace, MDisrupt experts can accelerate every stage of health product development. From fractional leadership to on-demand operators and stakeholder research, our platform matches you with the very best vetted and curated experts.

Operators on-demand

Regulatory, clinical, market access, commercial and product, and more.

Medical advisory boards

Build a medical advisory board. Access 30+ different clinical specialties.

Clinical user surveys

Rapid feedback from providers and payors on product concepts, reimbursement, and more.

Health product feedback

Get real-world input on your products from practicing clinicians.

Focus groups

Test and iterate new ideas with providers, payors, lab leaders, and health system executives.

Custom solutions

Need something else?

Let’s talk.

From start to scale, experts for every company at any stage.

Categories

Women’s health

Men’s health

Mental health

Genomics

Chronic care

Acute care

Oncology

Lab testing

Technologies

Class I and Class II medical devices, SAMD, apps, wearables, remote patient monitoring, digital therapeutics, and more.

Accelerate. At every stage.

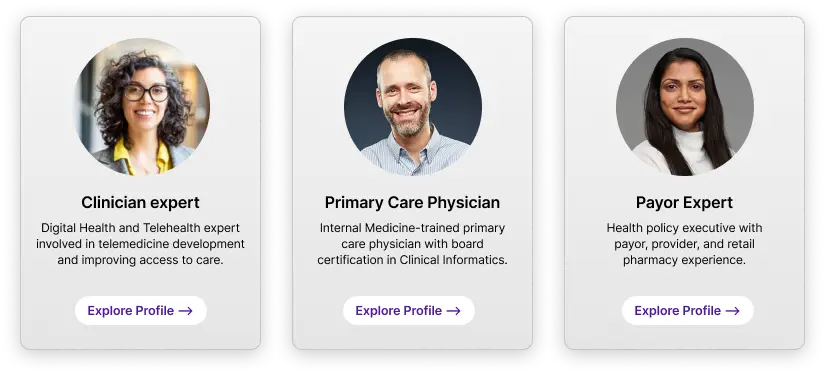

Example Expert Profiles

- Chief Medical Officer

- Regulatory Strategist

- Product Leaders

- Clinical Operations

- Commercial Strategist

Example Expert Profiles

- Medical Advisors

- Regulatory Operations

- Product Development

- Data and Lab scientists

- Go-to-Market Experts

Example Expert Profiles

- Medical Affairs

- Payor Strategists

- Reimbursement Expert

- Health Economists

- Outcomes Researchers

Example Expert Profiles

- Health System Executives

- Payor Relations

- Employer Channel Experts

- Pharma and Retail Leaders

- Patient Engagement

Why health technology companies trust MDisrupt to build their teams.

Hire Quickly

Get your shortlist of talent that’s ready to deliver faster through the MDisrupt tech-enabled platform.

We handle matching, contracts, payment, insurance, and legal so you can get to business faster.

Partner with MDisrupt for end-to-end support and custom solutions faster, with more accuracy and less risk.

Only the Best

Specialized clinicial and health technology experts average 10+ years of experience.

35+ clinical specialties available, featuring over 100+ expert skill sets.

Every expert is carefully curated and selected to ensure they meet the highest standards.

Tech-enabled

The MDisrupt Platform will guide you through setting up the details of your project.

Matching has never been better—now review expert profiles, resumes, and more on platform.

Manage your projects with more ease. Extend engagements, engage with new experts, and submit new requests hassle-free.

Over 100 companies served

Explore our content

The Playbook to

Building Digital Health

A multi-part webinar series that explores the major steps to building digital health solutions from inception to adoption featuring some of the industry’s leading experts.

Perspectives and Insights:

The MDisrupt Blog

Explore our blog where the MDisrupt team and leading digital health experts lend insight on a variety of topics from the importance of clinical outcomes to product market-fit, and more.