So, you have a new health technology that you’ve packaged into a hot product offering. You’re excited about your product. As you think about going to market, you practice reciting all the great things about your offering. This product’s going to take the world by storm! Your largest potential market: self-insured employers.

You’re not alone. The self-insured employer (SIE) marketplace is enormous. And with each year, more medium-sized and smaller employers are joining the fray. According to the most recent EBRI (Employee Benefit Research Institute) findings research, 78.5% of employers with 500 or more employees offered a self-insured health plan. That’s translates into more than 56,000 plans covering more than 75 million participants, according to a recent Deloitte study prepared for the Department of Labor.

However, self-insured employers are barraged by “next best thing” solutions touting a new technology that will revolutionize the marketplace in a new or unique way. Some recent examples include:

A new diagnostic blood test to help fine tune the treatment for certain kinds of cancer

A new application of telecommunications technology to optimize patient/provider interaction

Targeted pharmacogenomic testing for psychiatric therapeutics

A new stem cell treatment for joint injuries

A condition-specific self-management app

A new imaging technology that can be offered onsite.

So how can you break through the noise and get attention in this crowded market? First, you need to understand what self-insured employers are trying to accomplish. The four key strategies that usually drive SIE business goals for benefits are:

Self-funded health insurance plans enable employers to better customize plan and coverage options, as well as to better target cost-saving strategies. Naturally, employers struggling with escalating medical costs are looking for the next big thing. SIEs, in particular are sensitive to medical costs since they are spending “their own” money.

To do this, employers typically choose one of two options: an Administrative Service Only (ASO) plan from an insurance carrier, or a Third Party Administrator (TPA) plan. ASOs tend to be more turnkey, offering ease of administration and more limited plan options. TPAs tend to be more flexible and enable employers greater choice in plan design and offerings. The distinction is important, as the appetite and feasibility for new solutions increases with greater employer flexibility.

Many SIEs are willing to consider leading edge solutions if they can be convinced that the return on investment is worth the risk and the hassle.

Understanding not just what your new product offers but how it aligns with what a particular SIE wants to accomplish makes all the difference in the world. Understanding employer cost drivers and identifying specific ways that those costs might be avoided or reduced is key to making a smart, targeted pitch to your potential customers.

Many healthtech companies promise medical cost reduction through marketplace innovation. But they often underestimate the level of detailed understanding of medical spending that SIEs and their advisors have. Increasingly, employers can influence cost trends and clinical drivers to an impressive degree. Some of the key factors many SIEs consider include

Cost per member

Utilization trends

Acute and chronic conditions

Gaps in care

Risk scores pharmacy/medical ratios for their plans.

These metrics can be further analyzed by company location, member type (employee, spouse and dependent), and by plan.

It is vital to understand precisely what metrics your new health product will impact, and how it will change them in new ways.

Most SIEs have an insurance carrier, or some other plan administrator, process their medical claims. These carriers and administrators abide by a set of clinical policies that relate to medical necessity. Some policies may be developed internally, some externally. Some common examples include:

Is your service in accordance with generally accepted standards of medical practice?

Is it clinically appropriate and effective?

Is it not primarily for convenience?

Is it less expensive than an equivalent alternative service?

Is it endorsed or recommended by national medical societies and associations?

Does your technology have final approval from the appropriate governmental regulatory bodies, when required? (FDA approval, where applicable, is necessary but not sufficient to meet coverage criteria.)

Is your service covered by Medicare? While carriers are not obligated to follow Medicare policy for their commercial members, it is often considered in formulating clinical policies for commercial plans.

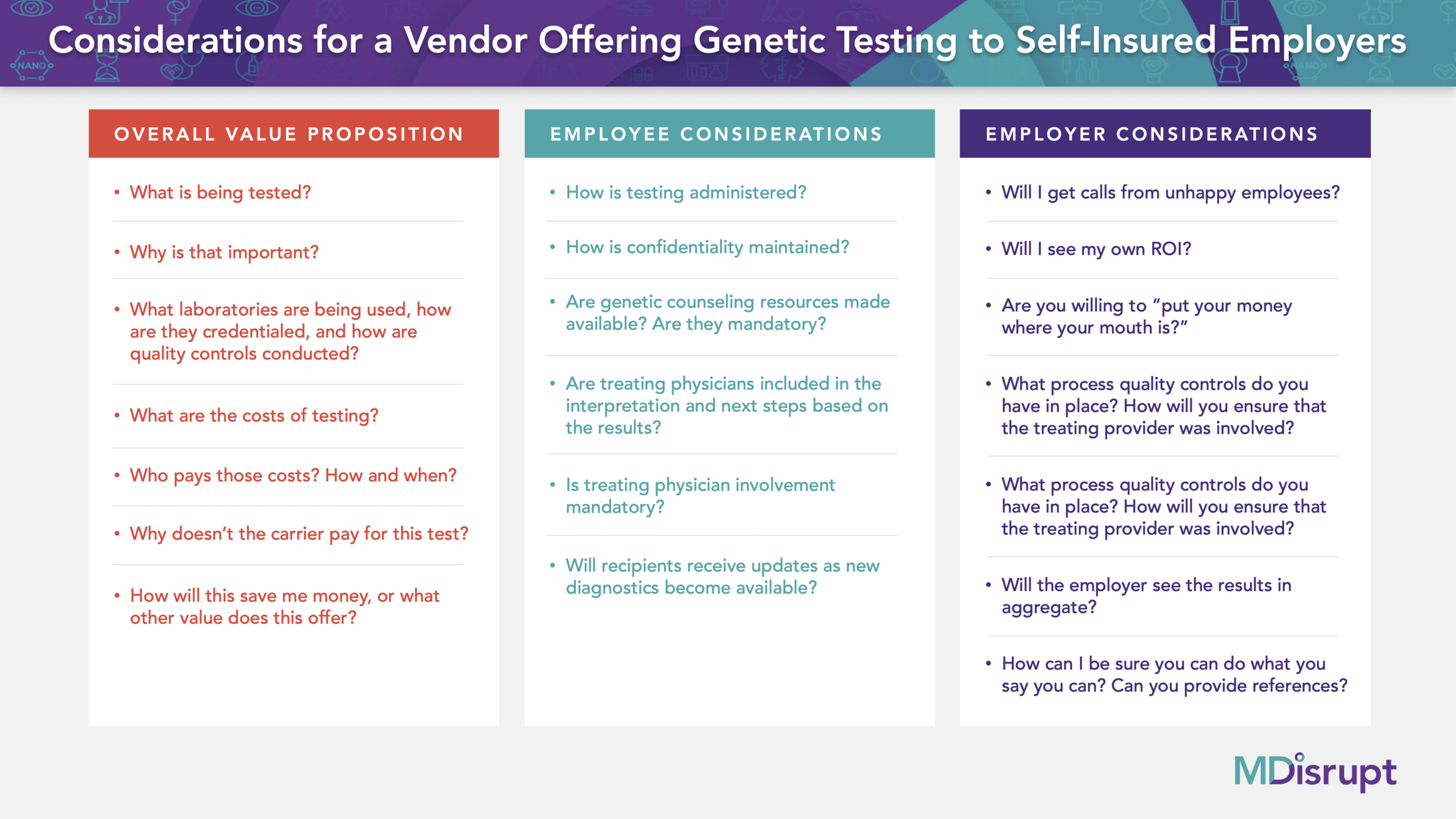

When considering a new diagnostic, therapeutic or behavioral change solution as part of an employee benefits plan, there are some basic questions you should be prepared to answer for a SIE:

What does the new capability offer?

What is the upside of offering the new technology?

What are some of the potential downsides?

Do the benefits outweigh the costs?

Is it medical necessary? Is it advisable?

What population is it intended for?

How will it be implemented and what are the costs associated with implementation? (I.e. does it require a blood draw or physician order, and if so are those baked into the solution and costs?)

What are the ethical and legal ramifications of including this in the benefits program?

What’s the ROI or the VOI (Value on Investment)? Can you prove it?

Are any other employers doing this? Why or why not?

In addition to understanding the details of what you offer and believing that it will accomplish what you say it will, employers need some assurances about your own credibility. Here are a few additional questions they might have for you?

Can you do what you say you will do, and do it well?

Do you have a proven track record?

What will the service experience for the employees? For their families?

What will we see from you?

What kind of reporting do you offer back to us?

Anticipating this piece of the conversation is vital for new healthtech disruptors: The more you can answer these questions truthfully and with confidence, the better your position to get to the next step.

Wherever possible, providing a predicted ROI is advisable (a range is acceptable). Assume that your SIE has a sophisticated understanding of ROI and be as specific as possible. Dollars spent on your product and program should be demonstrable by key indicators. Thinking through the “what ifs” shows you understand their world. An even stronger case can be made if you’re willing to put dollars at risk.

Before you knock on the door, have proof of concept. Pilots or case studies are critical to your credibility. Upstart enterprises will inevitably face a “chicken and egg” conundrum for this. You need to solve for that. Funding your own study in some way may be something to think about.