Going global: Taking your health product to international markets

US medical device and molecular diagnostics (MDx) developers are often laser-focused on establishing and growing their businesses stateside, with little to no attention paid to some important international healthcare markets. For example, the medical device market was expected to reach $150 billion in 2017 in the US alone—certainly a sizable market. However, when looking outside of the US, the global medical device market was set to reach close to $400 billion. The key to successful international growth is understanding which markets are truly accessible to you and mapping out a go-to-market strategy for each region.

Over the last 15 years, I have helped several startups expand their businesses to more than 30 markets globally. It has been a hugely rewarding (but mostly humbling!) experience. In joining the MDisrupt team, I now feel I can help so many more companies cross borders with their technology in a strategic, risk-mitigated way. I can help you ask the right questions and make the right risk calls as you contemplate international expansion.

Diversify your portfolio

Why should you consider expanding your business internationally? More than simply expanding your total addressable market, it’s a risk mitigation strategy! While most US companies consider international expansion to be fraught with risk and complexity, they fail to realize just how volatile the US market is and just how quickly their best-laid plans can fail. One swift action by the FDA or one unfavorable coverage determination by a top US payers can compromise your game plan before you’ve even gone to market. Going international with your product is like diversifying your investment portfolio: you can mitigate the risk of unexpected downturns in any one market.

As a topical example, COVID-19 has not impacted all countries uniformly. In fact, while case numbers were steadily rising across Europe and the US, my partners in Singapore were already recovering thanks to early containment measures. As a result, Singapore, Australia and some other international markets fared much better in the face of this global pandemic and were able to resume normal business activities before the close of Q2’2020. If your business model relies on revenue from US hospitals alone—hospitals now completely overrun with COVID-19 cases—the pandemic may pose an irrecoverable threat to your company.

Look for easily accessible international markets first

When should you consider doing this? The short answer is as soon as you have the opportunity to do so without compromising your product and market developments in your priority market. For startups, this is always a difficult decision due to resource constraints. For instance, Brazil is a seemingly attractive opportunity, boasting Latin America’s largest hospital market, but you should be aware of its prohibitive import tariffs and product registration requirements. Brazil may not present a near term opportunity given that you will have to invest substantially in product regionalization, translations of collateral, and regulatory approvals. Always invest in your priority market development first, and at the earliest opportunity, identify an international market that is relatively accessible. A good choice is one which requires little product regionalization (perhaps the dominant language is English) and one that doesn’t pose significant regulatory or product registration hurdles. One such example in Latin America is Colombia, the region’s third-largest economy and one that has business-friendly economic policies. You may be shocked to learn that some international markets are easier to sell into than your own!

Options for international expansion

There are three general approaches to international business expansion:

- Direct to market: As the manufacturer, you will set up a local entity and sell your product directly to clients. This means you are responsible for all client support, client contracting, local marketing and hiring locally, etc.

- Distributors: An in-territory company is contracted to represent your company under exclusive or non-exclusive distribution terms. Most distributor agreements are time-bound and subject to sales performance targets negotiated between the parties. The distributor manages all client relationships and generally assumes responsibility for marketing and client support. In this scenario you will need to support the distributor company with training and marketing materials and generally the distributor will expect a margin of 25-35%, depending on whether the product is an instrument, a consumable, or a medical device.

- Tech-transfer (licensing): Under a licensing agreement, you will transfer intellectual property rights to a third party to manufacture, further develop and/or sell your medical device or molecular diagnostic. These agreements contain terms related to revenue expectations and a proposed royalty structure, as well as territory and renewal terms.

The go-to-market approach that is right for your company depends very much on the following factors:

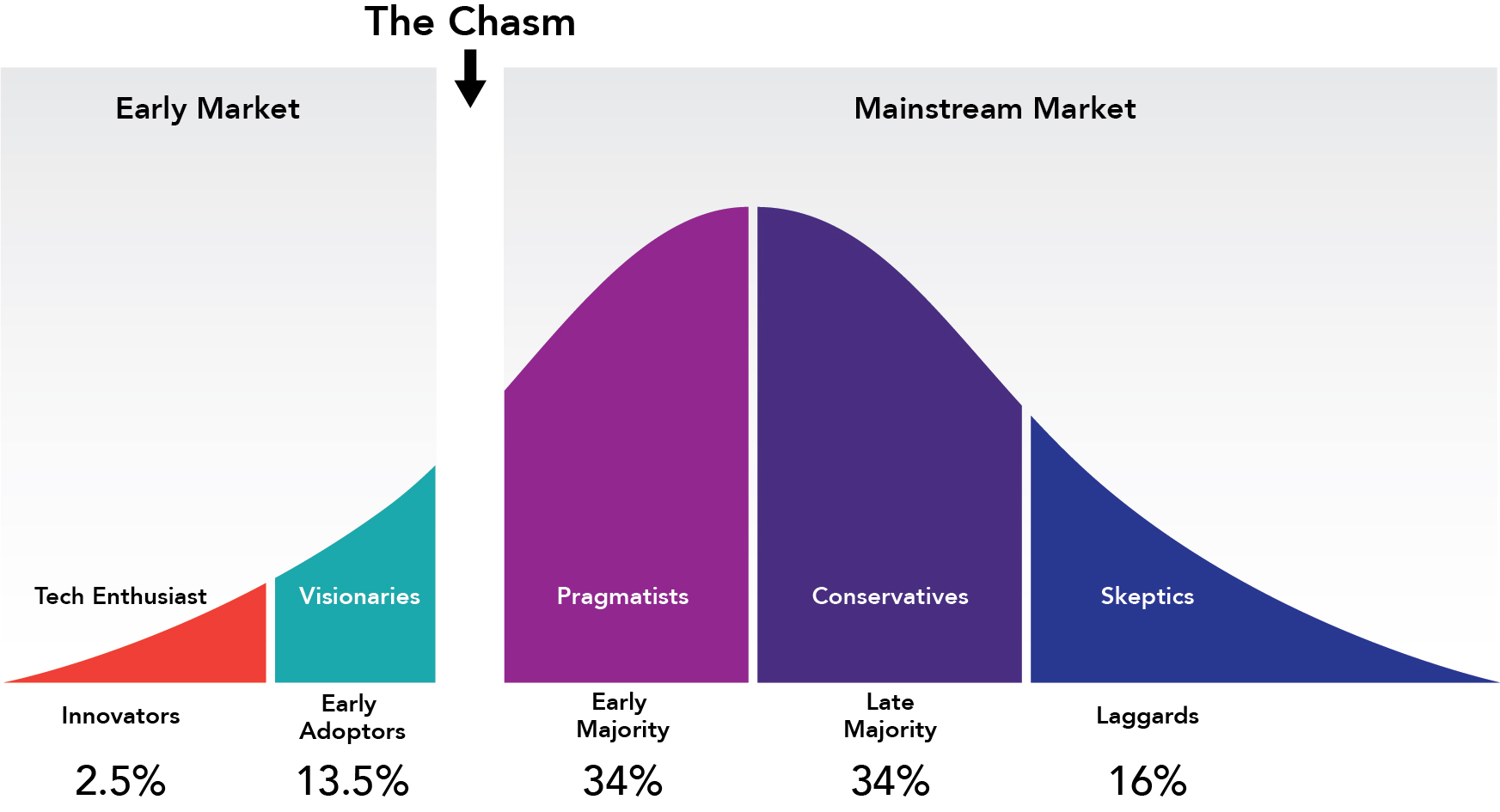

- The stage of your product in the technology adoption life cycle. If your technology is so innovative that you find yourself in the “early market” phase, you don’t need a distributor, you need market developers. Market developers are key opinion leaders in your field who are critical to the early adoption and validation of your product (or concept). They are highly published and influential in their respective fields. When you’re in the early market phase, there is nothing more critical than building relationships with these key opinion leaders. They will help you build evidence and credibility behind your product and will help engage the “early majority” to cross the chasm (see Fig. 1). At this stage, your biggest competitive threat is the status quo, and a typical distributor will not spend time developing your market for you when they can sell something else more easily.On the other hand, if you have a product for which there are known or established predicates in-market, then you may find yourself in the “mainstream” market. In this case, it would be perfectly appropriate to seek a local representative for your company as they can help you set competitive pricing and competitive positioning for your product. At this stage, your biggest competitive threats are the incumbents who have been in-market for some time before you and who you will have to displace. Here, distributors are a good fit because there is an established market for your product which they presumably understand and know better than you.

Fig. 1

- Local supply chain practices: In some countries, like Japan, you have to sell your products through an in-country distributor. In Japan, hospitals are contracted with local distributors for all of their medical and health tech supplies. The customary “kereitsu” structure remains prominent, and you must be familiar with this structure and partner with the right distributor to access your target clients. In other countries, import permits for medical devices are only granted to local companies, so you may have to work with a local distributor in these cases. Alternatively you may opt to have a third party like EMERGO file your device registrations, and designate them as the permit holders if you don’t want to be beholden to a commercial distributor.

- How well you know your market and your user: many companies in the “early market” stage make assumptions about what the market needs. Are you confident you understand the market problem your product is solving and furthermore, are you confident that the market will pay your asking price to fix it? (See our blog on the 8 common mistakes healthtech companies make when building their health products) You may find it beneficial to take a direct-to-market approach initially, to allow direct communication with your user base. These types of market insights may not be relayed to you if you are working through a distributor. You could find yourself with a distributor who is under-performing and you won’t understand why.

- Privacy laws: a growing number of countries now restrict the export of genetic samples and of genetic data. In fact, the enactment of GDPR by the European Commission in 2018 has set in motion tighter privacy laws around the world. If you are a molecular diagnostics developer, this may cause you to have to consider either buying or partnering with a local lab to both process test samples and interpret test results. It may mean localizing your database, too. If the market opportunity isn’t sizable enough to consider setting up your own operations, then an out-licensing model may provide a viable path to market.

Date before you marry: finding the right distributor for your company

Should you determine that the distributor/channel model is the best path to market for your company, you should plan to invest some time doing your due diligence on prospective partners. Getting this step wrong can cost you greatly and can cause irreparable harm to your client relationships. Here are some things to consider:

- Network: Inquire about current sales channels: who are the distributor’s current customers? How well does their client list overlap with your target list? How well connected are they with relevant key opinion leaders in their region? Inquire about their current product roster and sales performance to gauge their level of penetration in the market and their ability to close and manage large accounts.

- Reputation: your product may be best-in-class and best-in-market, but if you’ve tethered yourself to a partner who has soured relationships with potential clients in the past, you are wasting your time and may not even know it. You should ask for a client reference list and ask institutional partners in that region for any feedback about the distributor.

- Resident expertise: what skill set is needed to engage the top clients and train them on your product? Does the distributor have those resources in-house? For instance, if you are selling a pharmacogenomic test, you will want to look for distributors who have resident pharmacists or pharmacologists on staff.

- Communication: There are a few rules of engagement when dealing with international clients and partners: Learn to pronounce their names properly and ask them for help if you’re unsure. This may sound basic, but it’s not. It’s incredibly important for showing respect, and it’s also very helpful to learn how to pronounce foreign names, because then you can track conversations more effectively. Make an effort, as they do with you. Second, if you don’t speak the local language(which is often the case), make sure that your point of contact is fully fluent in your language. Those 11 pm phone calls will be much easier.

- Accreditations: Select a partner who will be a good steward of your company’s brand. Ask them about their company’s values and ask them what other companies they are representing. You should also ask for proof of any relevant accreditations (ISO, CLIA/CAP, NATA, as the case may be).

- Salesmanship: ask them to pitch you your own product, slide deck and all. You want to see a) whether they have done their homework and b) how much they understand your product’s value proposition.

- Street-price: In some countries (Hong Kong, Japan), the distributor model is layered, the result of which is an inflated street price. Make sure you agree on a street /retail price range.

- Trial period: There is mutual benefit to both the distributor and the manufacturer to evaluate the business relationship with a short pilot or a trial period. The distributor can begin marketing your product and understanding what resources will be needed to successfully sell it. Throughout this period, you will be able to gauge the distributor’s effectiveness. In my experience, you can catch several red flags through this process!

Going global with your health tech product can be transformative for your business and can help you absorb inevitable market fluctuations. A carefully crafted strategy which considers the status of your technology’s adoption life cycle and a risk-benefit analysis of the path to market (direct, channel, or out-license) is of critical importance to the success of your international expansion.

Morgan Donaldson, VP of Business Development, MDisrupt

Morgan Donaldson is a business development executive with more than 15 years of experience bringing genomics technologies and molecular diagnostics to global markets (EMEA, LATAM, APAC, North America). She has developed international sales channels, managed business development teams, led product developments, led contract negotiations with Fortune 500s and participated in due diligence assessments. She has led the international growth strategy for several genomics startups in the Bay Area and in Canada.

Whether you are an international company and looking to bring your health product to the US, or a US company considering global markets, MDisrupt can help you ask the right questions, prioritize target markets and de-risk the process for you.

Talk to us—we can help.