Many healthtech companies want to access the self-insured employer market. In my previous blog, How Healthtech Companies Can Successfully Access the Self-Insured Employer Market I highlighted the important factors that healthtech companies need to consider when accessing this channel. Many companies focus on this channel as a way to commercialize and drive adoption before their product is reimbursed by a health insurance plan.

The goal of this blog is to help you understand some of the key definitions that are important to understand in this channel and the process by which decisions are made.

Let’s get familiar with the important definitions:

- Self-Insured Employers: While the risk falls on the insurance company in a fully insured plan, in a self-insured plan the employer or company assumes most of the risk. Businesses that have self-insured plans must pay for employee medical claims and associated fees from their own general assets. Larger employers tend to be self-insured. The percentage of medium and smaller companies that self-insure is growing significantly.

- Insurance Company: A company that offers health plans to customers. These can also be known as medical insurance companies or health insurance carriers.

- Health Plan: A health insurance policy with defined benefits coverage. An employer can offer several health plans, from one or several health insurance companies.

- Benefits Coverage: Defines both the dollar amounts of coverage (i.e., contributions, deductibles and copays) and the medical services covered.

- Medical Necessity: A determination as to whether and when a medical service should be covered (paid for) by the insurance company.

- Clinical Policy: A written document containing the clinical rationale for medical necessity determinations for a particular medical treatment or diagnostic.

Now that we understand the terms, let’s get back to the central conundrum that new healthtech companies face:

“Why should I pay for this if it isn’t covered by the insurance company?”

In other words, If an employer’s medical insurance company doesn’t cover a diagnostic or therapeutic service, why should the employer consider buying it separately?

The answer is found in the corridor between “medical necessity” and what can be argued is genuinely “medically necessary.” In order to prove that your product/service is medically necessary, you first need to understand the medical insurance company’s medical necessity policies for your technology.

Medical Necessity: Health Plan Clinical Policies

As defined above, medical necessity is the process for determining benefits coverage and/or provider payment for services, tests or procedures that are medically appropriate and cost-effective.

Some policies may be developed internally, some externally. Most medical insurance companies maintain a clinical policy unit of internal and external clinical advisors that apply their own process of medical diligence which includes:

-

Regularly monitoring new treatment, technologies and indications

-

Reviewing new treatments submitted for coverage

-

Searching the National Library of Medicine’s PubMed database of peer-reviewed medical literature

-

Assessing regulatory statutes of new technologies (e.g., FDA)

-

Reviewing evidence-based clinical practice guidelines, such as the Agency for Healthcare Research and Quality’s (AHRQ) National Guideline Clearinghouse database

-

Reviewing recommendations of national medical societies and their guidelines.

-

Considering the indications accepted by the USP DI (United States Pharmacopeia-Drug Information) and ASHP (American Society of Health-System Pharmacists) for drug treatments

-

Assessing the opinions of relevant experts where necessary.

As described in my previous blog, most employers have insurance companies, or some other plan administrator, process medical claims. These insurance companies and administrators abide by a set of clinical policies around medical necessity established by the clinical policy unit(s). These policies apply these criteria for assessing a service, test or procedure:

-

Is it in accordance with generally accepted standards of medical practice?

-

Is it clinically appropriate and effective?

-

Is it not primarily for convenience?

-

Is it not more costly than an equivalent alternative service?

-

Is it endorsed or recommended by national medical societies and associations?

-

The technology must have final approval from the appropriate governmental regulatory bodies, when required. FDA approval, where applicable, is necessary but not sufficient to meet coverage criteria.

-

Medical insurance companies are not obligated to follow Medicare policy for their commercial members. Medicare coverage policy is often considered, however, in formulating clinical policies for commercial plans.

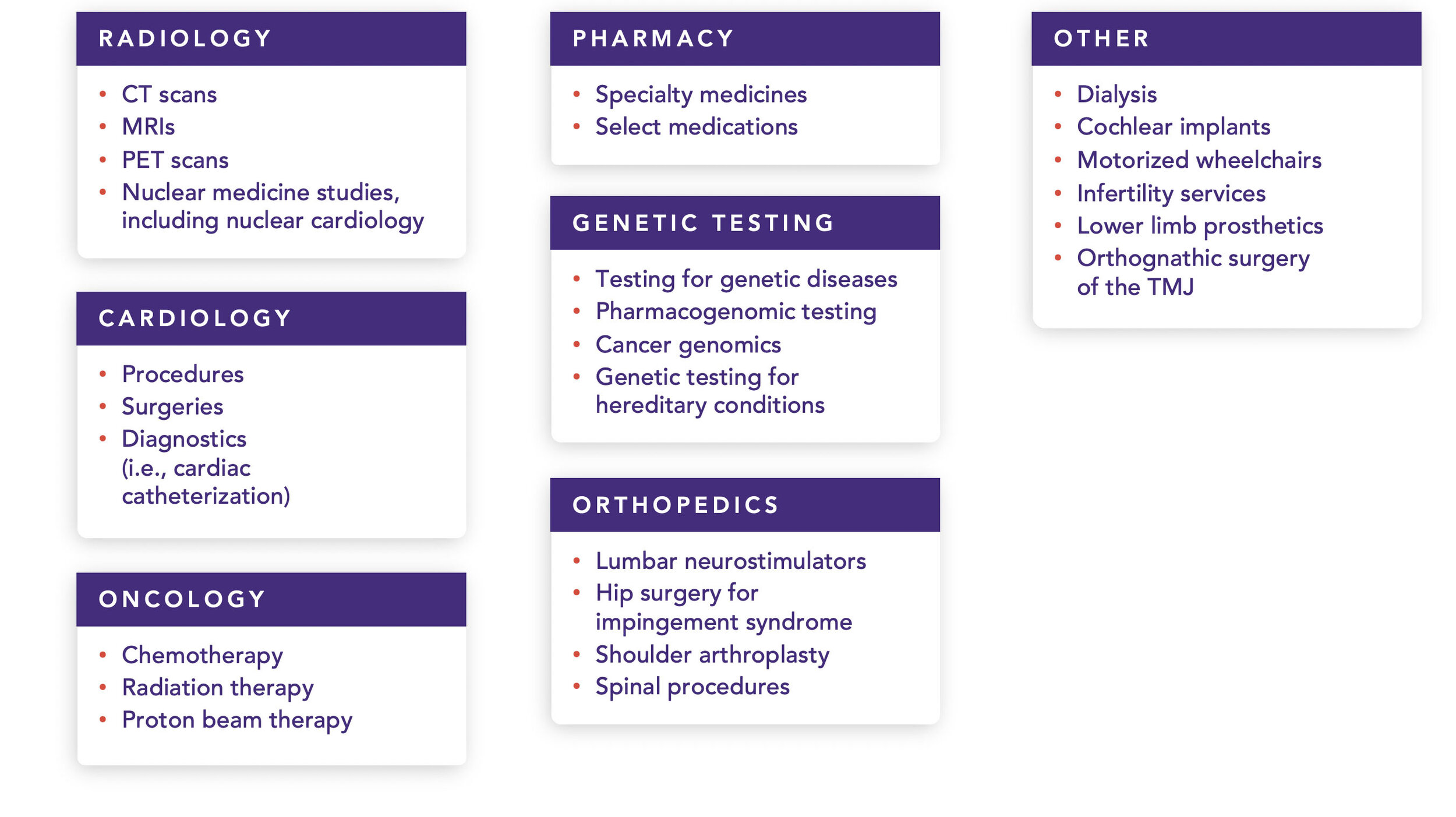

Medical necessity determinations arise most commonly where the service requested is subject to pre-authorization procedures. Here are some of the most common categories for pre-authorization:

Frequently Required Pre-Authorizations

The challenge, then, is how a healthtech company justifies the cost of the new service in light of the medical insurance company’s clinical policy. In order to do that, a healthtech company needs to understand what the clinical policy language is for medical insurance companies,recognizing that they can often vary. In some cases, levels or degrees of coverage (including frequency, duration, pre-authorization requirements) may vary based on group plan design. Examples include: number of allowed physical therapy visits, coverage for alternative treatments such as acupuncture, and length of stay for substance abuse rehab.

Each policy includes:

-

Coverage rationale that includes the scope of the decisions rendered, as well as their context

-

Documentation requirements for treating providers

-

Definitions of terms used in the policy

-

Applicable codes including CPT (medical procedures) and ICD10 (medical diagnosis) codes

-

Description of services, e.g. a more complete review of when and how the services addressed shall be treated

-

Clinical evidence including a discussion of major studies, guidelines and other research used to craft the decision. These are defined here in the blog The Formula for Widespread Adoption of health Products that Every Investor and Healthtech Entrepreneur Needs to Know.

-

US Food and Drug Administration status, including relevant approvals from the FDA

-

Centers For Medicare And Medicaid Services status, including relevant information about what Medicare and Medicaid typically cover in the area addressed

-

References e.g. a useful bibliography for healthtech companies

-

Policy history/revision information e.g. a review of previous iterations of the current policy

-

Instructions for use e.g. a description of how the medical insurance company administers the policy.

Depending on the type of service, some healthtech companies may directly pursue the insurance companies. In most cases, however, marketing healthtech services directly to the self-insured employer should include a rationale as to why the covering insurance company does not cover the product or service.

Clinical policies can also be leveraged to identify what sources are used to establish the relevant clinical policy. The sources include: individual academic studies, national medical society guidelines, federal agency criteria (such as the FDA), federal institute guidelines (such as the CDC and the NIH), specialty and subspecialty medical colleges and organizations, and a fair number of others. These materials may be useful to make the case for your product or service.

Examples of Medical Insurance Company Clinical Policies:

For purposes of illustration, the following is a small subset of some of the clinical policies published by United Healthcare in a single year period.

Key Points For HealthTech Founders

-

Healthtech companies need to understand how health insurance companies define medical necessity in order to make the case for the solution they are bringing to the self-insured employer.

-

Medical necessity defines what is covered by a health insurance plan in a general population. That definition is intended to protect the self-insured employer and its covered members from paying for medical services that are excessive, cost-inefficient, or not clinically warranted.

-

The opportunities for healthtech companies looking to directly reach self-insured employers lie in making the case for the business value of the solutions offered.

Medical Necessity: Finding the Leading Edge, Avoiding the Bleeding Edge

In my next blog post, we will examine how healthtech companies can make the case for medically necessity even when an employer’s health plan does not cover the service.

This includes addressing the following questions:

- What are the major reasons that a new approach should be covered even when the medical insurance company doesn’t cover it?

- What advantages does your approach have (i.e., selection of appropriate members, place of service, etc.) that are not currently in place that can help maximize the return of investment for the service?

- Why should an employer proactively include this service and pay for it above and beyond what is covered by the medical insurance company?

- Will the service bypass, reduce, pre-empt or help avoid other costs incurred by the employer’s health plan?

Ronald S. Leopold, MD, MBA, MPH, Physician Consultant

MDisrupt Guest Blogger Specializing in Employee Benefits, Medical Cost Solutions, New Medical Technology

As a credentialed and experienced professional, Dr. Leopold brings credibility and a breadth of knowledge as a consultant, client advocate, and marketplace spokesperson. He is an industry thought leader in employee benefits and health and productivity.

Specialties: Medical Costs, High Cost Claimants, New Medical Technologies, Employee Benefits, Heath and Productivity, Population Health Data Analytics, Global Workforce, Generations in the Workforce, Financial Wellness, Thought Leadership, Public Speaking.

Accessing the self-insured employer channel correctly takes special expertise. If this channel is key to your commercial strategy, talk to us—we can help.